By Julia Lane, Intern.

It’s that time of year again. The air is crisp, couples dressed in J.Crew knits walk down the street consuming pumpkin-flavored beverages, and recent college graduates receive their first student loan repayment bills.

If you graduated this spring and took out loans to fund your education, which according to the College Board’s 2013 Trends in Student Aid is more than half of you, your six-month student loan grace period is probably about to expire. This means you will be receiving a bill soon which will mark the beginning of your repayment period. Like Batkid’s fight against crime, repayment is no joke, missing a payment could affect your credit score, your ability to rent an apartment or even your eligibility for a job.

Be smart about your repayment. Here are four things you can do now before your first student loan payment is due:

1. Get Organized

It’s probably been several years since you took out your first student loan, and with finals, graduation, and post-college plans you might have become a little hazy about the details. Since you are going to have to start repaying those loans soon, it’s important that you know how much you owe and what kind of loans you have. You can log into the federal government’s student aid website (studentloans.gov) using your Federal Student Aid pin to view your loan balances, information about your loan servicers, interest rates, and more.

2. Say Hello to your Loan Servicer

While you’re on that website, check out who your loan servicer is. A loan servicer is a company that collects your federal student loans payments on behalf of the U.S Department of Education. Once you’ve found out who your loan servicer is, go to their webpage and make sure your contact information is updated. You don’t want your loan bill collecting dust at your mom’s house because you moved over the summer.

3. When Life Gives you Loans, Make Monthly Repayments

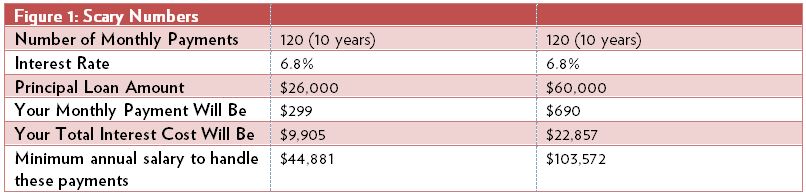

So how big of a bill should you be expecting? Your monthly payment will depend on three main things: how much you borrowed, your interest rate, and what kind of repayment plan you choose. For example, the average student who earned a bachelor’s degree in 2011-12 graduated with $26,500 in debt. If their loans had an interest rate of 6.8% and they chose a standard repayment plan of 10 years, then their monthly bill will be almost $300. Overall, they will end up paying a little less than $10,000 in interest over the course of 10 years. In order to make these payments, it is recommended that they have a yearly income of at least $45,000. Take a look at the chart below for more examples.

Estimates were made using Mapping your Future’s Student Loan Repayment Calculator

Estimates were made using Mapping your Future’s Student Loan Repayment Calculator

4. Create a Game Plan for your Repayment Plan

I know, $300 dollars a month is a lot of money, but before you start bulk-buying Top Ramen; you should consider what repayment options you have available to you. For many recent grads, even minimum monthly payments under the standard 10-year repayment plan may be too much to handle at first (we feel your pain theater majors). Luckily, you’ve got repayment options, such as income-sensitive or extended repayment that may lower your monthly bill. While low or reduced monthly payments might mean that you’ll have a little extra cash for fun things, you will end up paying more in the long-run, as unpaid interest is capitalized, increasing your principle loan amount.

Want more information on student loan repayment? Talk to your loan servicer or your college’s student loan officers for more personalized information and repayment options.

Advanced Readings:

Four Common Student Loan Mistakes

Everything You Need to Know about 7 Student Loan Repayment Plans

Federal Student Aid | U.S Department of Education