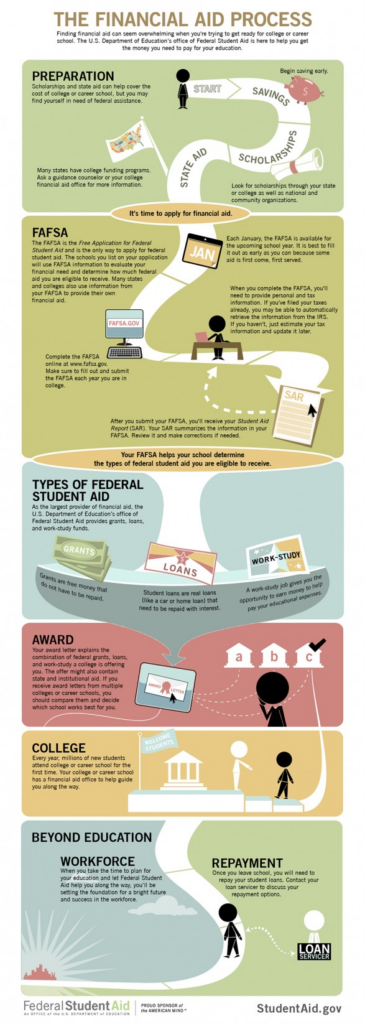

Executive Director Robin Redmond published an Op-Ed to the Chicago Sun-Times after Maryland passed a law banning scholarship displacement by public universities. “Some displacement defenders say they need to recapture financial aid resources to disburse it to other students with financial need,” says Redmond. “But the logic here is off and is exactly the opposite […]

Chicago Sun-Times Op-Ed: When a Smart Kid Wins a Scholarship, Why Does Illinois Cheap Out?